A key part of the Government’s housing agenda is the pledge to deliver 1.5 million homes over five years and increase homeownership. But current market conditions point to a widening gap between what’s viable to build and what people can afford to buy.

Since 2022, the cost of delivering a new home has risen by 17%, while new-build sales values have increased by just 1%. [1]

Private housing starts are 40% below early-2022 levels, and planning approvals have also fallen, signs that the pipeline is thinning just as housing targets step up. [1]

The geography of the problem

The tension plays out differently across England. The latest Zoopla Homebuilding Viability Report 2025 highlights a critical challenge: only 36% of England is currently viable for new housing-led development, with 64% facing viability constraints and 48% outright unviable. [1]

In higher-value southern markets, more schemes remain technically viable but are increasingly unaffordable to local buyers. In the Midlands and the North, prices are more affordable but many sites are unviable at current costs and values.

This inverse relationship makes it harder to meet targets and expand homeownership without policy support that addresses both sides of the equation.

Fewer new-build purchases despite ongoing completions

Alongside weaker viability, new-build purchase volumes have dropped in the last two years, even where completions have held up. London has seen record-low private new-build sales, reflecting higher borrowing costs and the withdrawal of first-time buyer support. [2]

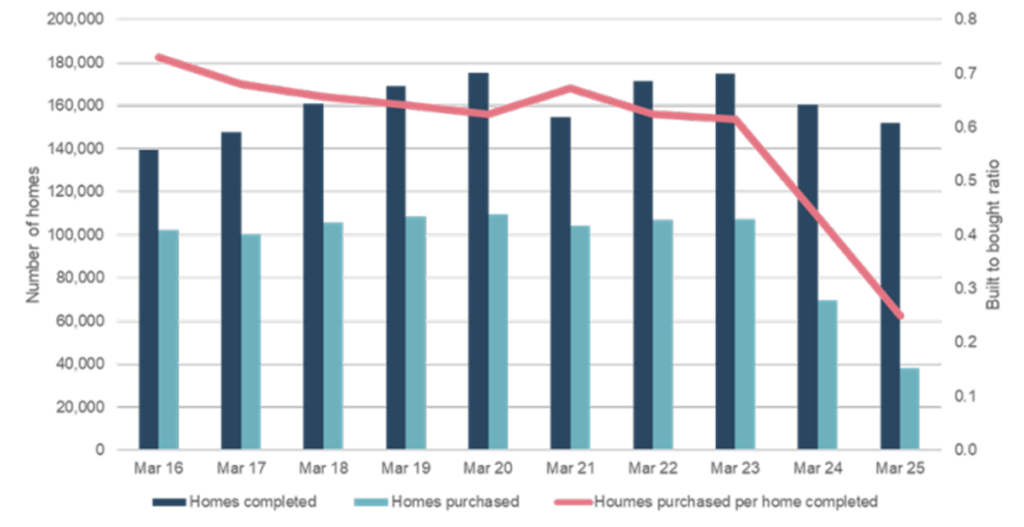

Nationally, the ratio of new-build homes purchased to homes completed has fallen sharply compared with the mid-2010s. In the year ending March 2025, 151,000 homes were built in England, with only 38,000 purchased (a ratio of 0.25 new homes purchased per home built). [3] [4]

In contrast, back in 2016, 140,000 new homes were built, and over 100,000 were purchased (a ratio of 0.73).

Figure 1 – New build homes completed versus purchased by year ending March 2016-2025

This decline in purchasing coincides with the removal of policies that previously lowered deposits and transaction costs for first-time buyers, including the end of Help to Buy (equity loan) in 2023 and the expiry of temporary stamp duty thresholds in March 2025. [5] [6]

These changes have raised the cash needed to complete a purchase and reduced access to high loan-to-value mortgages.

What could help?

Progress is most likely where viability and absorption are tackled together. Mixed-tenure delivery and risk-sharing between public and private partners can keep schemes moving through the cycle and broaden the buyer/renter base. Homes England’s support at Middlewood Locks, Salford, including a recent £30 million development finance loan, illustrates how this approach can underpin delivery across successive phases. [7] [8] [9]

Reflections post budget

The November 2025 Budget provided limited relief for a housing market already under pressure. Despite expectations, no Stamp Duty reductions or first-time buyer incentives were announced. Instead, the Chancellor confirmed an annual “mansion tax” on homes valued above £2 million from April 2028 and a 2 percentage-point increase in tax on property rental income. Alongside these fiscal measures, £48 million has been allocated to boost local authority planning capacity, funding approximately 350 additional planning posts.

These measures collectively signal a focus on fiscal consolidation and supply-side delivery, rather than stimulating demand. While the planning investment should help to unlock stalled sites and improve decision-making times, the Budget offered no direct support for affordability or market absorption. As a result, the gap between viability and affordability is likely to persist, particularly in lower-value markets where development economics remain challenging.

[1] Zoopla, 2025. The viability gap: where is it viable for home builders to build new homes in England?

[2] Retrieved from: https://www.standard.co.uk/business/sales-new-build-homes-london-collapse-all-time-low-molior-sadiq-khan-b1248183.html. Accessed November 2025

[3] ONS, 2025. Indicators of house building, UK: permanent dwellings started and completed by country

[4] ONS, 2025. Residential property sales by Middle layer Super Output Area

[5] Retrieved from: https://www.gov.uk/help-to-buy-equity-loan. Accessed November 2025

[6] Retrieved from: Stamp Duty Land Tax — temporary increase to thresholds Accessed November 2025

[7] Retrieved from: Transformation of Middlewood Locks to continue with £30m deal – GOV.UK. Accessed November 2025

[8] Retrieved from: Middlewood Locks, Salford – Scarborough Group. Accessed November 2025

[9] Retrieved from: Metro Holdings Limited. Accessed November 2025

[10] Retrieved from: https://www.rtpi.org.uk/new-from-the-rtpi/major-financial-boost-for-planning-teams-in-autumn-budget/. Accessed December 2025