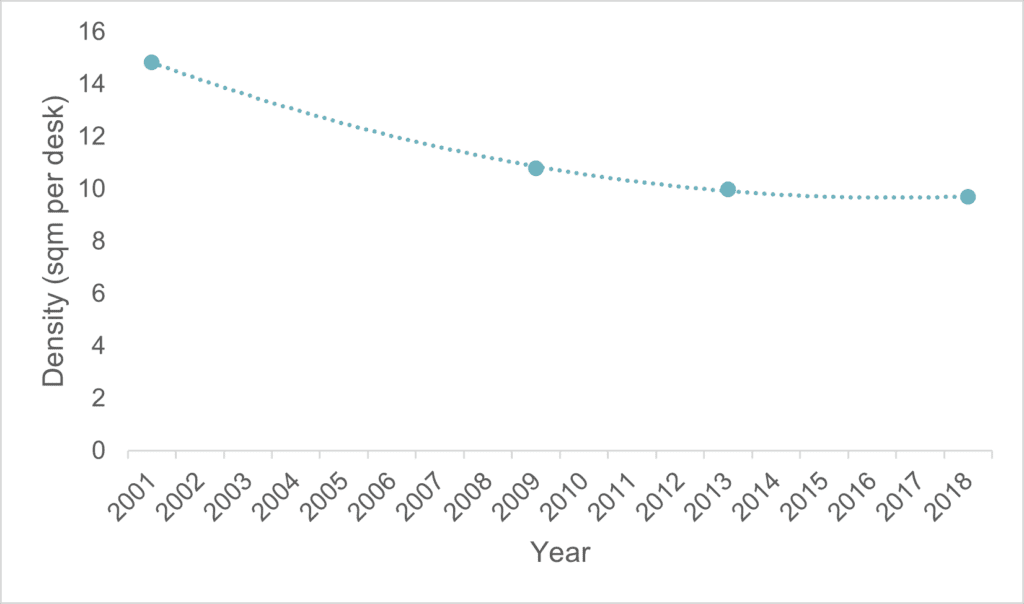

Historically, office employment densities in London have been consistently increasing as more workers have been fit into smaller spaces. It is likely that average office employment densities for prime urban areas reached as high as one full-time equivalent job per 10sqm of office space before the outbreak of the coronavirus pandemic (hereafter ‘the pandemic’). Ostensibly there was no logical reason for this trend to not continue and plateau at a point of maximum efficiency. However, the pandemic has resulted in an abrupt disruption of this trend, as companies reevaluate what they need in office spaces. This blog piece assesses the magnitude of the pandemic’s impact on office employment densities and suggests what trends might be seen in the future.

The pre-pandemic trend:

The City Corporation have found that pre-pandemic office demand in London had continually increased due to its globally renowned status as a business and financial centre.[1] This growth, alongside factors such as increasing demand, cost optimisation measures, and evolving workplace designs, all contributed to consistent growth in office employment densities across London before the pandemic.

In addition, increasing rental costs and a global economic crisis have forced organisations to maximise the efficiency of the office spaces they were inhabiting. A 2020 survey found that approximately 62% of Chief Financial Officers were actively seeking costs reductions related to improving efficiency at the time.[2] Workspaces increasingly pushed to include design measures such as hot desking systems and open plan layouts to accommodate more employees within a smaller space, demonstrated by a 26% increase in open-plan offices in London between 2012 and 2017.[3]

Figure 1 – Since 2001 there has been a continual trend of more employees occupying a smaller amount of office floorspace

Benchmark employment density of UK offices over time (2001 – 2018)

Source: Leesman, 2022. Leesman+ Certification

Impact of the pandemic:

According to the latest research, London’s global status as a leading financial centre has not changed as a result of the pandemic. The City Corporation suggests that as of 2023, London ranks in joint first place with New York as the most competitive business destination worldwide.[4] The measure considers the innovative ecosystems, reach of financial activity, business infrastructure, access to talent, and the regulatory environment of cities globally. However, 2023 represents the first year that London has not been the sole leader under this measure. Evidence suggests that this is not the result of retrogressive processes such as a decline in the quality of London’s office spaces or a knock-on consequence of political shifts such as Brexit, but rather that New York has caught up through substantial growth in tech investment. Despite this, it is clear that alternative global financial centres (New York, Singapore, and Frankfurt) are catching up and continuing to compete with London for investment from businesses.

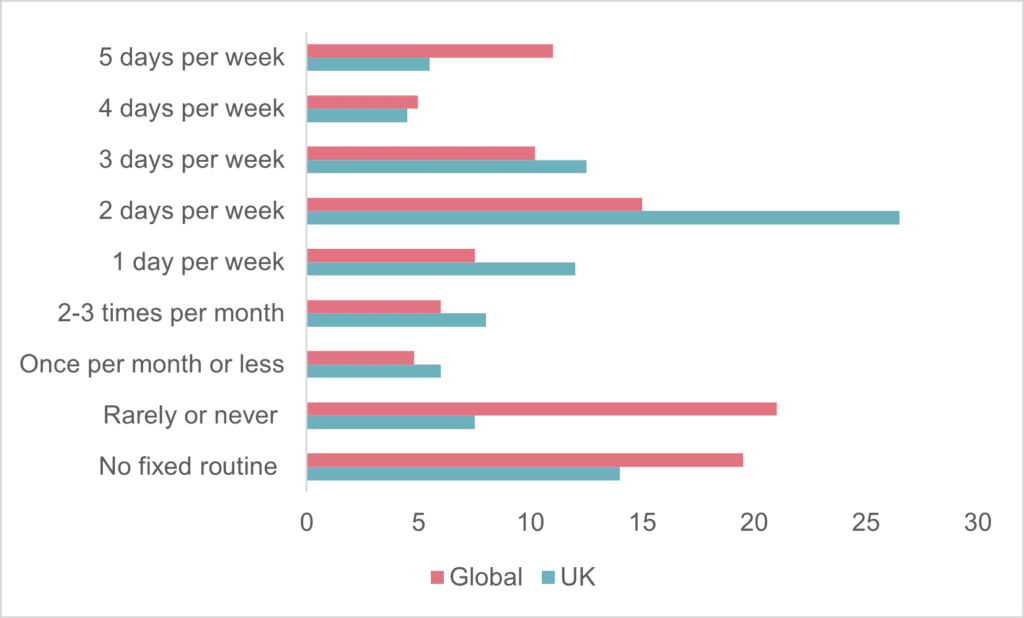

Lockdown measures implemented by the UK government led to the forced uptake of remote work. The continued use of hybrid working applications such as Microsoft Teams or Zoom have now become engrained into the running of the workplace. These applications have contributed to levels of home working remaining high as lockdown restrictions have eased. London in particular continues to see high levels of home working with 37% of workers reporting that they now do so partially from home. [5] The proportion of workers in London that engage in homeworking has grown by approximately 23 percentage points since 2019. Additionally, as illustrated in Figure 2, 2022 survey data from the British Council of Offices (BCO) suggests that the UK is leading the way relative to the global average in terms of adopting hybrid working patterns, as opposed to completely remote or 5-day working weeks.

Figure 2 – Most employees in the UK plan to be in the office two days per week

Weekdays employees plan to be in the office (Q3 2021 – Q2 2022)

Source: BCO, 2022. The Future of UK Office Densities

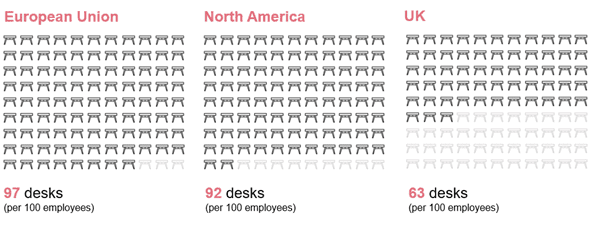

According to the BCO’s The Future of UK Office Densities report, the most common office working pattern in the UK in 2022 (over 25%) is working in the office two days per week.[6] Recent findings from the AWA Hybrid Working Index surveying large businesses show that employees worldwide are spending dramatically less time in the office than pre-pandemic. If total days in the office per week is presented as 5.0, the survey finds that employees pre-pandemic spent on average 3.8 days in the office, and as of 2022 surveyed employees spent an average of 1.5 days in the office. However, it should be noted that this survey reflects large multinational corporations which are typically quicker to embrace work from home patterns. It is also likely that there has been a greater return to office in 2023 compared to 2022. Another source specific to central London suggests that in 2023 workers spent on average 2.3 days in the office per week, which is likely to be more accurate.[7] Additionally, the AWA Hybrid Working Index states that out of all regions studied, the UK has the lowest number of desks per 100 people, with on average 63 desks per 100 employees.[8] This supports the above conclusion that the UK is leading the way in adopting hybrid working patterns in the post-pandemic era, with a faster uptake of systems such as hotdesking.

Figure 3 – In 2022, there were significantly fewer desks per 100 employees in the UK compared to other geographies

Desk provision per 100 employees across geographies

Data taken from: AWA, 2022. AWA Hybrid Working Index

Future density scenarios:

Recently, Central London Forward have presented three different return to the office scenarios for Central London:[9]

- Employers place some additional pressure on employees to attend the office, for example at least three days a week or 65% of 2019 rates.

- Back to the office scenario – over time employers are successful in enticing workers to return and working patterns resemble what was seen pre-pandemic.

- Workers attend the office the same amount that they do currently (approximately 50% of 2019 levels).

Interestingly, in all three of these scenarios, the level of inhabited office floorspace in London is not projected to return to pre-pandemic levels until 2030 at the earliest (2041 at the latest). This would suggest that employment densities will continue to decrease for a significant time.

However, in recent years there has been a “flight to quality” within the London office market creating a particular demand for prime office space. This has been driven by factors such as a desire for low-carbon office space with supporting amenities for workers. Additionally, the pandemic has strengthened the need for a high-quality office space to encourage employees to return to the office. Employees have benefitted from work from home arrangements due to its flexibility, employees now place greater value on the social benefits of their office space, rather than its efficiency which can be replicated at home. There is now greater demand for collaborative spaces rather than the efficient, busy workspaces that were common pre-pandemic, as workers seek to optimise in-person interactions in addition to work done remotely.

If this flight to quality continues, demand for best-in-class office floorspace in London will undoubtedly outpace supply. It is possible that employment densities could then rise once again to make the most out of scarce, best-in-class office space in London.

BCO research conducted through a series of member surveys has found that looking into the future, a sweet spot of 10-12sqm per desk is reasonable.[10] This starting point will need to be adjusted to accounting for hybrid working patterns, and continued uptake of hotdesking.

Some commentators have suggested that this figure is too conservative to base design specification guidelines for office space on. For example, some have argued that the continued uptake of hybrid working patterns and hotdesking is inevitable, and therefore office employment densities in London should be expected to increase to around 9sqm per office worker, back in line with what was recorded in 2018.[11],[12]

Either way, there is a lot of uncertainty in the factors influencing what an appropriate office employment density in the future could look like. Policymakers should continue to monitor these trends to ensure the UK’s cities are not left with spaces that do not meet the future needs of businesses.

[1] City of London Corporation, 2019. City of London office market analysis

[2] Garter, 2020. Gartner CFO Survey Reveals That 62% of CFOs Plan SG&A Cuts This Year Due to Coronavirus Related Disruptions

[3] BCO, 2020. BCO specification guide 2019

[4] City of London Corporation, 2023. Our global offer to business: London and the UK’s competitive strengths in support of growth

[5] ONS, 2023. Homeworking in the UK – regional patterns

[6] AWA, 2022. AWA Hybrid Working Index

[7] Centre for Cities, 2023. Just how many days are people working from the office?

[8] AWA, 2022. AWA Hybrid Working Index

[9] Central London Forward; Arup; Gerald Eve; LSE, 2022. The future of office in central London

[10] BCO, 2022. The Future of UK Office Densities

[11] CAG Consultants, 2021, London Employment Sites Database 2021

[12] WorkMind, 2022. The Future of UK Office Densities: New BCO guidance recommends more space per person