A significant part of our work at Volterra involves dealing with an uncertain future. Questions such as how many jobs a development will create, what strategy should an area adopt given we cannot predict how the economy will evolve, or how a new rail link will impact land use patterns around stations all require some forecasting of how individuals will react to change, and this is subject to significant uncertainty.

However, something that is less well understood is that uncertainty does not just pertain to the future but also the past.

Recent data from the ONS shows that the British economy was 0.6% larger in the fourth quarter of 2021 than in the final quarter of 2019. This is a significant shift compared to an earlier estimate, which indicated that it was 1.2% smaller.

This revision has undermined the narrative that has been told about our weak recovery from the pandemic. According to this data, which is also subject to uncertainty, Britain’s economy surpassed its pre-pandemic size ahead of other big European countries, more than a year and a half earlier than expected.

Part of the reason for this revision is the ONS now have richer data from their annual surveys and administration data, allowing them to estimate costs to businesses at a more granular level. However, changes to economic estimates are not uncommon.

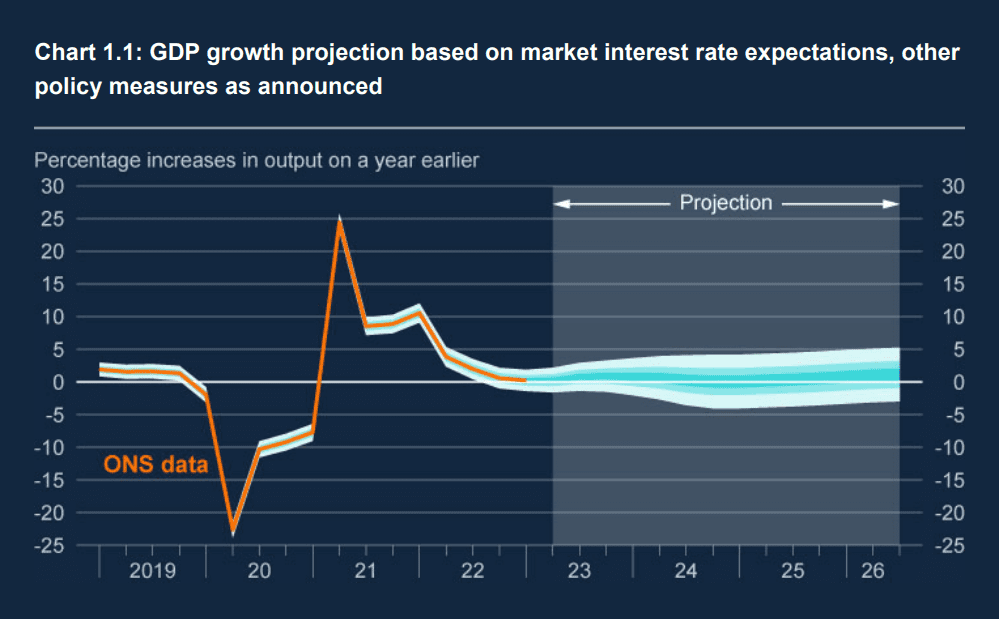

This chart from the Bank of England shows GDP growth projections over time. The distribution to the left of the shaded area reflects uncertainty surrounding revisions to the data in the past.

Revisions in GDP can be as big as changes from the previous periods. Historic recessions have been wiped out based on a statistical error.

One of our core values at Volterra is to recognise that the economy is complex and inherently unpredictable. It is essential to be transparent about this uncertainty in economic analysis.

The Bank of England chart above is useful in shifting away from stating that GDP growth will be and has been a specific, discrete number (e.g., 1.0%) to indicating that there is uncertainty, but this represents the likely range.

In the world of economic analysis, being open about uncertainty is essential. It helps us better understand the past, present and future.

Chart source: Bank of England Monetary Policy Report