Over the past twenty years the Greater London Authority (GLA) has produced forecasts of population and employment growth across the capital. These forecasts help us understand how and where the capital is expected to grow or change in future years. The GLA has recently produced an update to their employment forecasts, updating previous projections produced in 2017. These new forecasts provide the first look into how London’s workforce will change post-Covid, with forecasts of jobs growth provided up to 2051.

Historically, Volterra provided economic analysis in support of these forecasts, which are based on recent trends in growth alongside scenarios for long-term growth in economic output and productivity.

Which boroughs are likely to grow?

Over the past 30 years London has grown at a dramatic rate, recording an increase of almost 2 million jobs since 1991 alone. The projections estimate that London will grow from supporting a total of 6 million jobs in 2021 to 6.9 million by 2051, with the majority of this growth occurring in the next 10 years.

This begs the question of where in London will experience this growth. Is it anticipated to be the office-dominant centres of the City, Canary Wharf and Westminster which have been the focal point for employment growth in London since the global financial crisis, or has Covid changed where people want to work, and start and grow businesses?

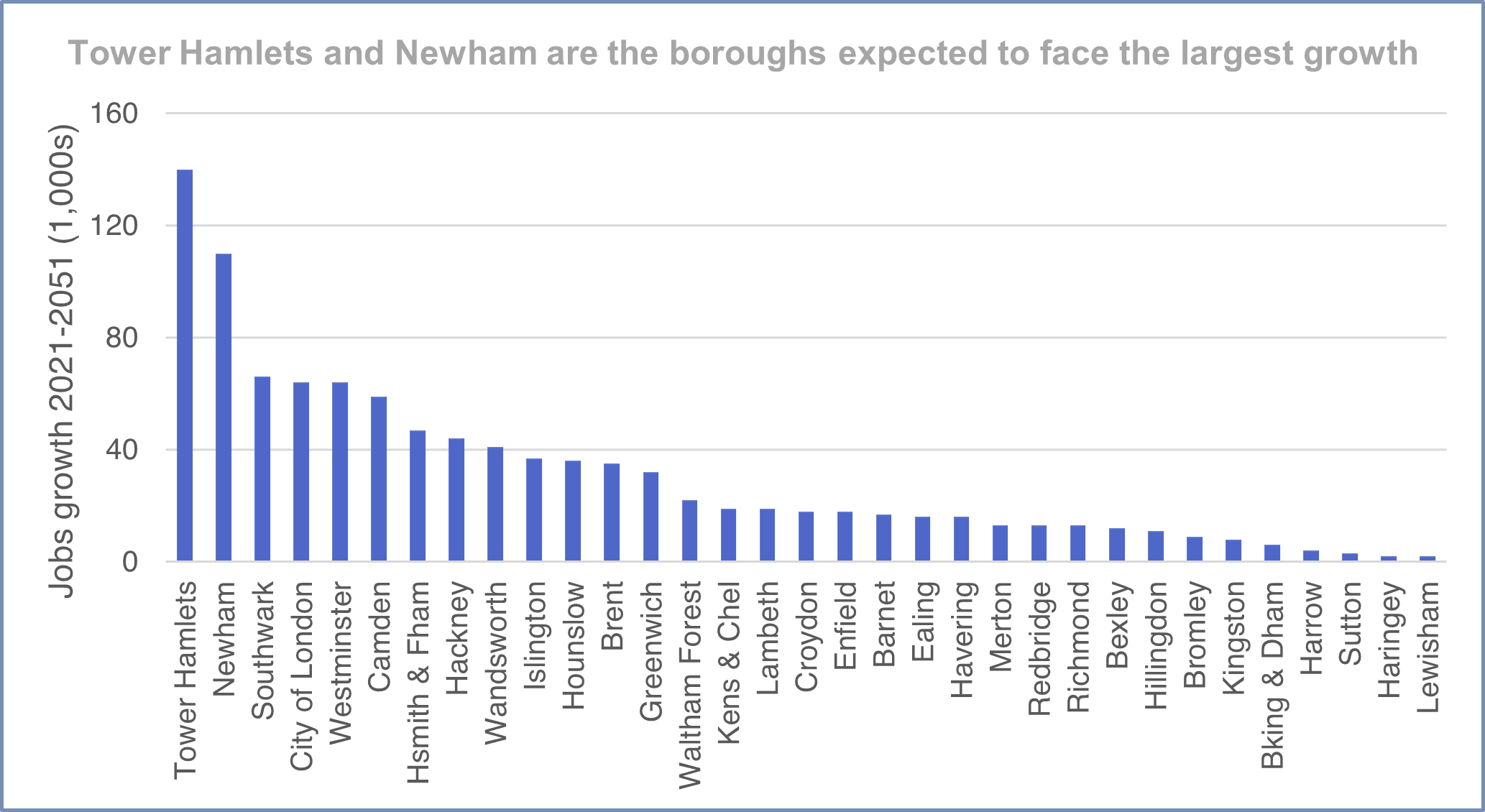

The projections estimate that the areas that would experience the largest growth by 2051 would be the boroughs of Tower Hamlets and Newham (seeing the largest absolute and relative growth rates at 140,000 and 110,000 new jobs respectively from 2021). This growth would align with significant development activity currently underway and expected these boroughs, with the continued expansion of space and employment at Canary Wharf and Whitechapel in Tower Hamlets, and new development at Stratford to the north and around the Royal Docks to the south of Newham.

In general, the forecasts predict that the central areas of London will continue to grow faster than outer London. When combined, the City of London, Hackney, Tower Hamlets, Newham, Greenwich and Southwark are forecast to account for over half of the growth in jobs to 2051. Notable exceptions are the outer London borough of Brent, with employment forecast to grow by 25% to 2051, and the central London borough of Lewisham, which faces the lowest level of growth of all 33 boroughs.

Projected employment growth by borough 2021-2051

Which sectors are likely to grow?

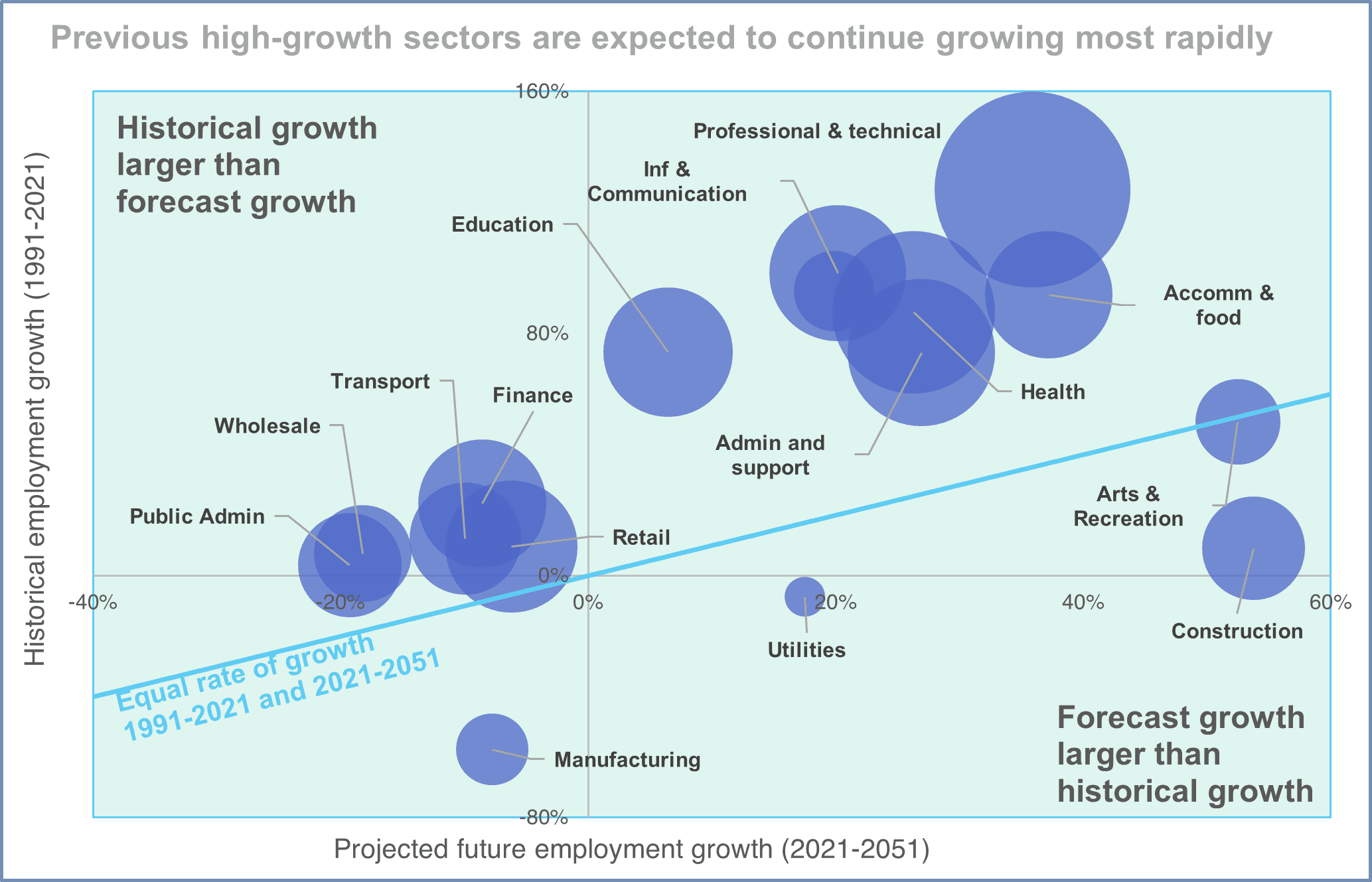

The forecasts suggest that sectors that experienced stronger growth historically – like professional & technical services and accommodation & food services – will continue to grow at relatively faster rates in the future.

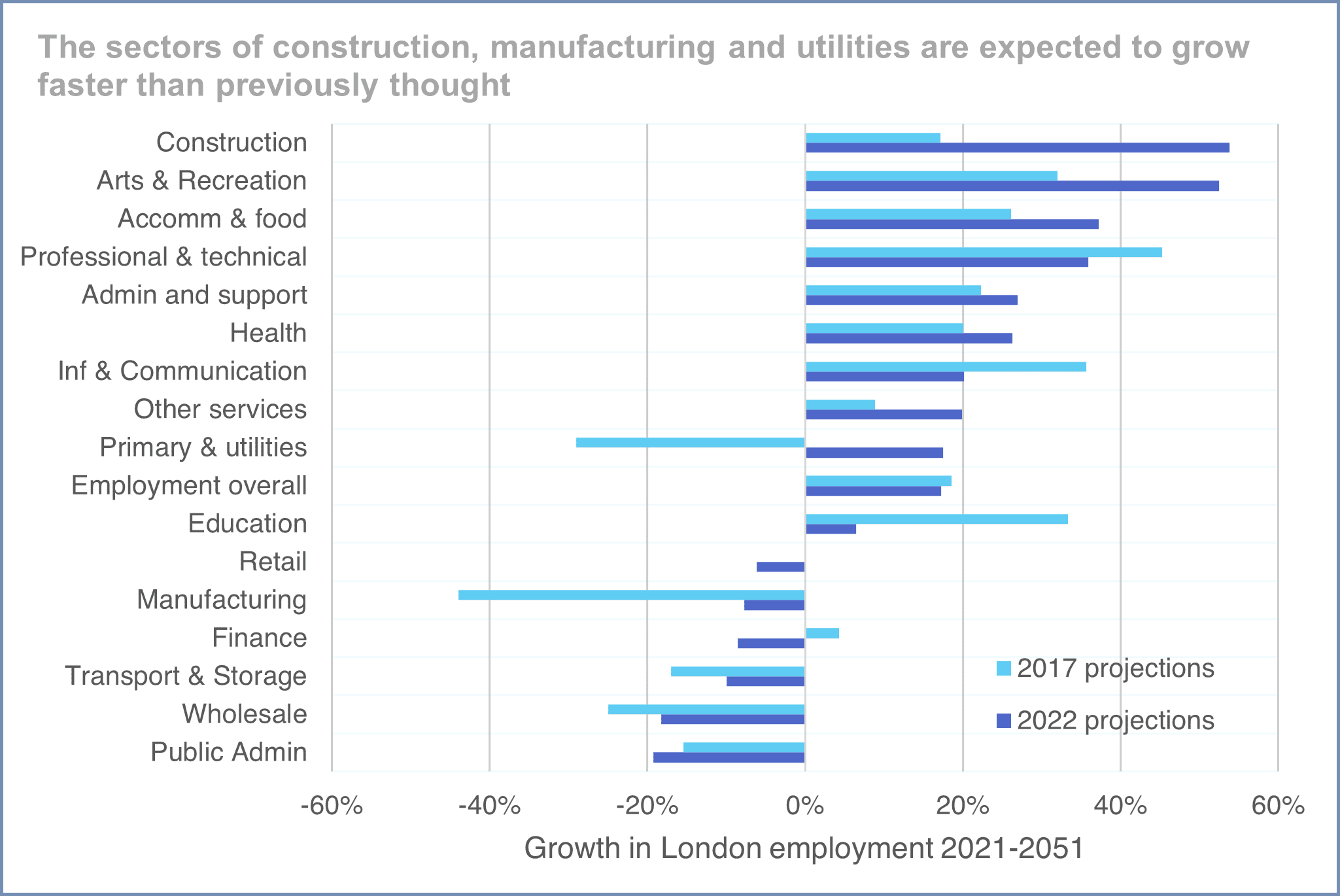

The updated projections identify several sectors that are forecast to lose jobs. Public administration and wholesale trade industries in particular are expected to fall, each reducing in size across the city by almost 20% by 2051. Of all the standard classifications of sectors the one expected to grow at the fastest rate is construction. The construction industry is forecast to face a 143,000 increase in employment over the period 2021-2051, but from a relatively lower base than other sectors such as professional & technical services.

Comparison of historical and projected employment growth by sector

The updated projections have significantly changed the outlook for a number of sectors. When compared to the previous 2017 projections, rates of growth in manufacturing and primary services have been revised upwards substantially (from decreases of 44% and 29% respectively to a decrease of 8% in manufacturing employment and an increase of 18% in primary services). The growth outlook for office-based sectors (including professional & technical, finance, and information & communication) has taken a hit in these forecasts, presumably impacted at least in part by changing working patterns away from traditional offices.

Projected growth in London employment by sector 2021-2051

How do these forecasts compare to pre-Covid forecasts?

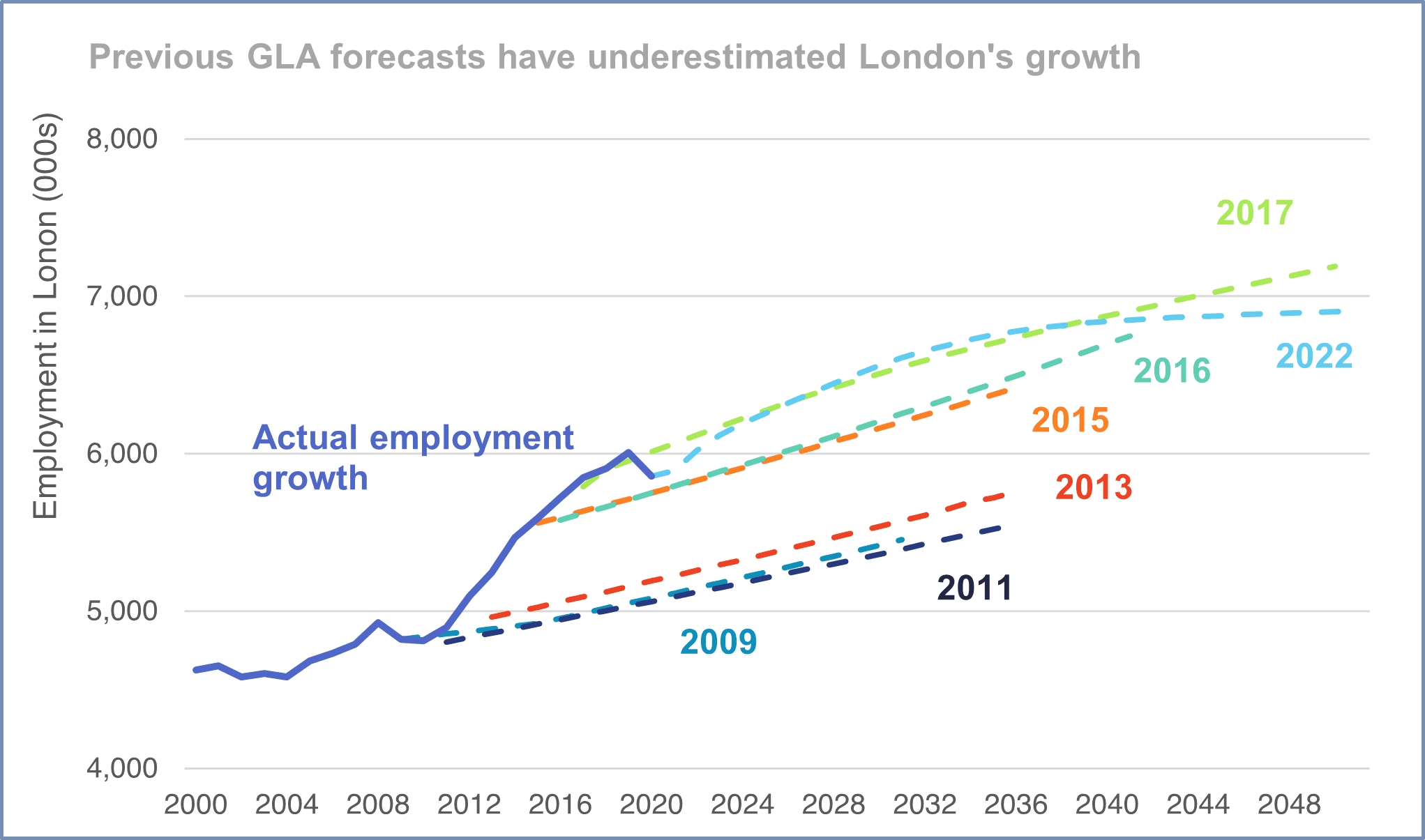

These projections are the first estimates by GLA since the Covid pandemic, which has rendered the 2017 projections out-of-date. The economic impact of the pandemic can be seen throughout the projections, with the update resulting in downwards revisions for growth in most boroughs and industries.

Not only has the pandemic resulted in a temporary dip of employment, but the GLA estimate it will result in long-term impacts on growth. The previous projections for growth from 2017 estimated that employment growth would stabilise at a figure of 0.4% per year. The 2022 updates now estimate this figure has reduced to 0.1% per year as a result of lower expectations of long-run growth across the whole of the UK.

Since 2009, the GLA’s forecasts have persistently underestimated the extent of growth in London, with increases in jobs between 2009 and 2019 far exceeding long-run historical growth rates. Each previous update to the forecasts has had to increase level of future growth of the city. The 2022 projections are the first time since the financial crisis where forecast long-run growth has had to be revised downwards.

GLA estimates for projected growth in London employment over time

So it is clear that the GLA believe that the pandemic and other macroeconomic changes have worsened the growth outlook for London. Time will tell how employment in the city will respond to fundamental changes in the way we live and work, such as increasing automation and shifts away from traditional forms of office employment to co-working and home working. However, the key narrative from these forecasts is of falling long-run rates of employment growth across the city. A positive outlook for London growth moving forward may have to settle for moving closer to pre-pandemic growth rather than exceeding it.

Peter Reddy

Image: pexels